Nifty Nov F: 12018 [ 12066/ 11972 ]

HVNs – 11667 / 11760 / 11814 / 11876 / ( 11901-920 ) / 11970 / 12015 / (12050)

Report to be updated…

(Click here to view NF making higher Value above the Gaussian composite from 30th Oct to 19th Nov)

- The NF Open was an Open Auction (OA)

- The day type was a Normal Variation Day (Up)

- Largest volume was traded at 12015 F

- Vwap of the session was at 12025 with volumes of 88.5 L and range of 93 points as it made a High-Low of 12009-11913

- NF confirmed a multi-day FA at 11465 on 16/10 and completed the 2 ATR move up of 11776. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11503 on 17/10 and completed the 2 ATR move up of 11808. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11162 on 09/10 and completed the 2 ATR move up of 11554. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 29/10 at 11810 will be important reference on the downside.

- The settlement day Roll Over point (Nov) is 11970

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12005-12015-12051

Hypos / Estimates for the next session:

a) NF needs to sustain above 12015 for a move higher to 12030-36 / 12052-60 & 12080

b) Staying below 12015, the auction could tag 11995-984 / 11969-960 & 11940-936

c) Above 12080, NF can probe higher to 12094 / 12112-121 & 12148-166

d) Below 11936, auction becomes weak for 11918-901 / 11885 & 11860

e) If 12166 is taken out, the auction go up to to 12185 / 12209 & 12226-236

f) Break of 11860 can trigger a move lower to 11846-833 / 11816*-810 & 11795

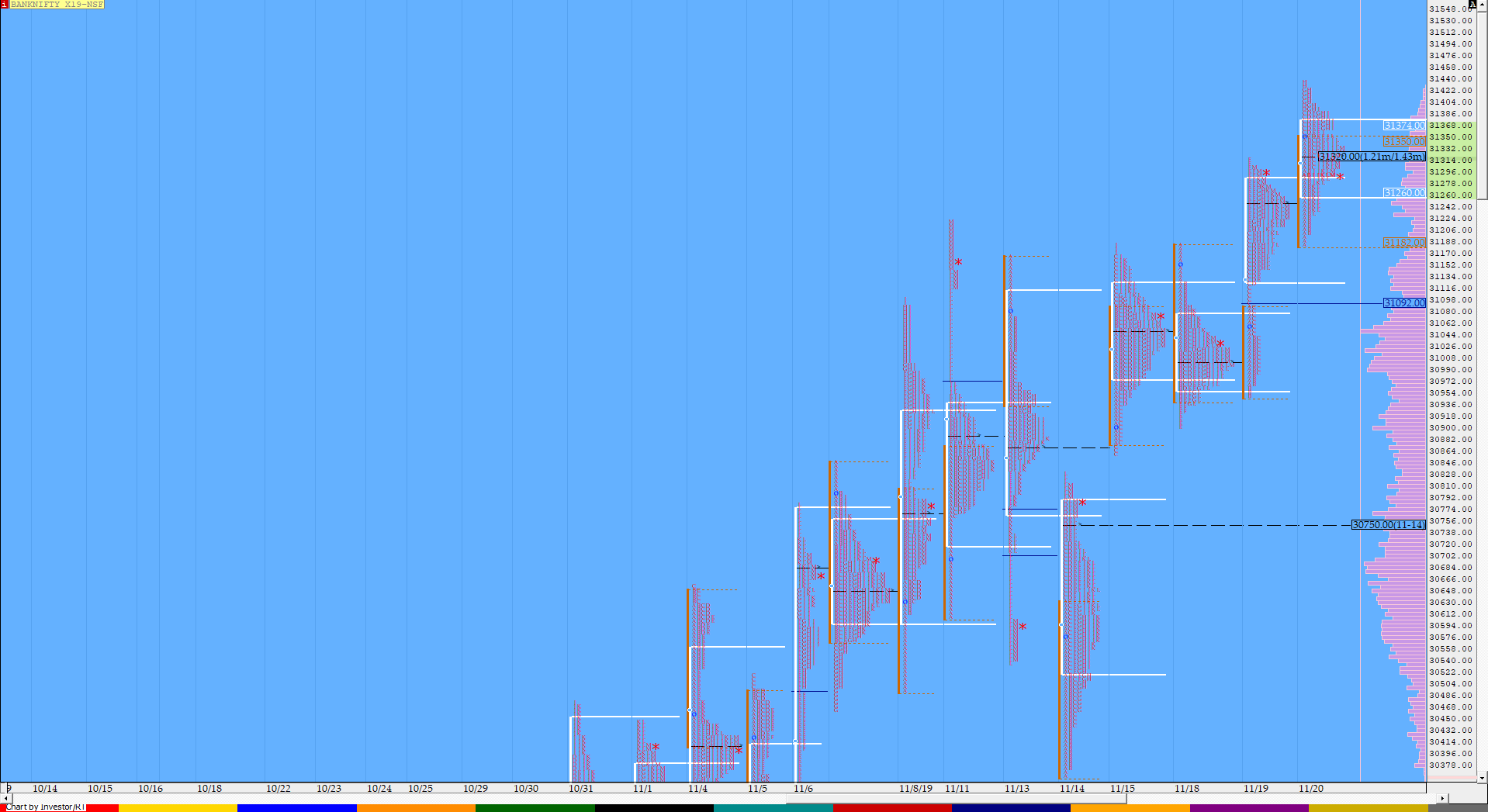

BankNifty Nov F: 31321 [ 31434 / 31184]

HVNs – 30075 / 30150 / 30288 / 30400 / 30690 / 30760 / 31020 / (31175) / 31250 / 31325

Report to be updated…

(Click here to view BNF form a 2-day ‘p’ composite profile)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up

- Largest volume was traded at 31325 F

- Vwap of the session was at 31320 with volumes of 28.1 L and range of 250 points as it made a High-Low of 31434-31184

- BNF confirmed a fresh FA at 30052 on 06/11 and tagged the 2 ATR target of 31049 on 08/11. This FA has not been tagged since & hence is now positional support

- BNF confirmed a FA at 27900 on 09/10 and completed the 2 ATR move up of 29779. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 06/11 at 30447 will be important reference on the downside.

- The Trend Day VWAP of 29/10 at 29945 will be important reference on the downside. This was tagged on 30/10 and broken but was swiftly rejected so proves to be support.

- The old Trend Day VWAP of 08/07 at 30995 is no longer valid reference now as BNF closed below this on 13/11

- The settlement day Roll Over point (Nov) is 30150

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31279-31325-31400

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31325 for a rise to 31360-392 / 31440-490 & 31560

b) Staying below 31325, the auction could test 31255-240 / 31180 & 31122-090

c) Above 31560, BNF can probe higher to 31618-640 / 31727-740 & 31784*-803

d) Below 31090, lower levels of 31020 / 30965-914 & 30860 could be tagged

e) If 31803 is taken out, BNF can give a fresh move up to 31875 / 31929-949 & 32001

f) Below 30860, we could see lower levels of 30770-750* / 30686-658 & 30585-580

Additional Hypos

g) Above 32001, higher levels of 32058-82 / 32140 & 32197-213 could get tagged

h) Break of 30580 could trigger a move down to 30540 / 30500-460 & 30375-370

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout