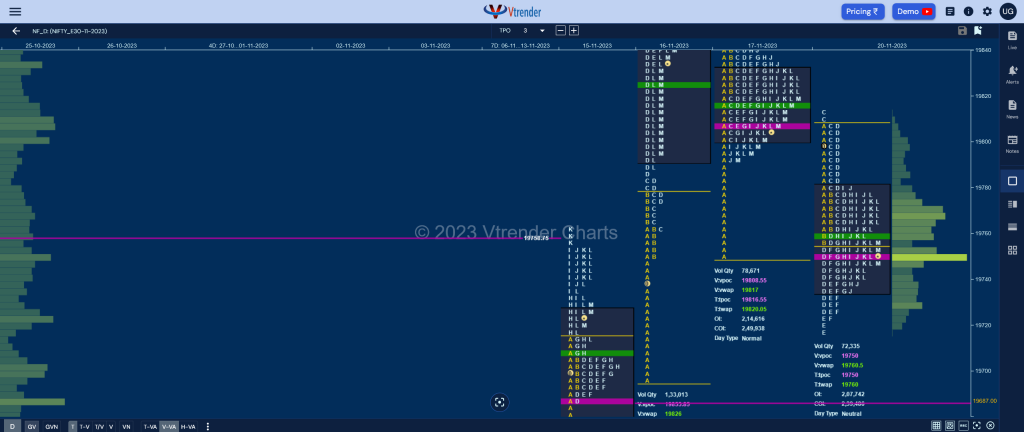

Nifty Nov F: 19751 [ 19813 / 19718 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 7,820 contracts |

| Initial Balance |

|---|

| 55 points (19810 – 19755) |

| Volumes of 18,160 contracts |

| Day Type |

|---|

| Neutral Centre – 95 points |

| Volumes of 72,335 contracts |

NF opened with a look up above the yPOC of 19808 but could only manage to tag 19810 as no fresh demand was seen triggering a probe lower for the rest of the Initial Balance (IB) and resulting in new lows of 19755 in the B period leaving an ultra narrow 55 point range taking support in previous session’s buying tail. (P.S: There was a freak tick at 19848 in the opening minute but OrderFlow did not show any volumes above 19810)

The auction then made a typical C side move in the opposite direction of the IB even making marginal new highs for the day at 19813 but once again it failed to attract buyers and this lack of demand at yPOC for the second time got the sellers interested and they made a sharp extension lower in the D TPO even confirming a Failed Auction (FA) at top as it made a lower low of 19718 in the E period but could not extend any further suggesting that the selling that came in was mostly local inventory.

NF then made a slow probe back above VWAP leaving a PBH at 19780 before settling down to close right at the dPOC of 19750 leaving a Neutral Centre Day with completely lower Value and a FA at top which will be the reference for this weekly settlement with the first objective on the downside being 19690.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19750 F and VWAP of the session was at 19760

- Value zones (volume profile) are at 19736-19750-19780

- NF confirmed a FA at 19813 on 20/11 and the 1 ATR objective on the downside comes to 19690

- NF confirmed a FA at 19385 on 06/11 and tagged the 2 ATR objective of 19704 on 15/11

- HVNs are at 19129 / 19213 / 19486** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 21st Nov 2023

| Up |

| 19780 – VAH from 20 Nov 19813 – FA from 20 Nov 19855 – PBH from 17 Nov 19895 – HVN from 16 Nov 19934 – Swing High (16 Nov) |

| Down |

| 19736 – VAL from 20 Nov 19690 – 1 ATR from FA (19813) 19643 – Weekly VWAP 19592 – Gap Mid-point (15 Nov) 19554 – 1 ATR (VPOC 19687) |

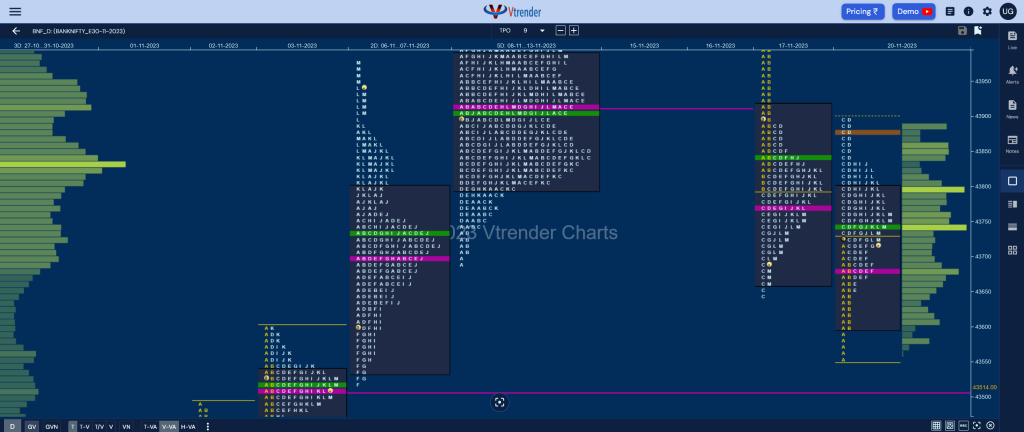

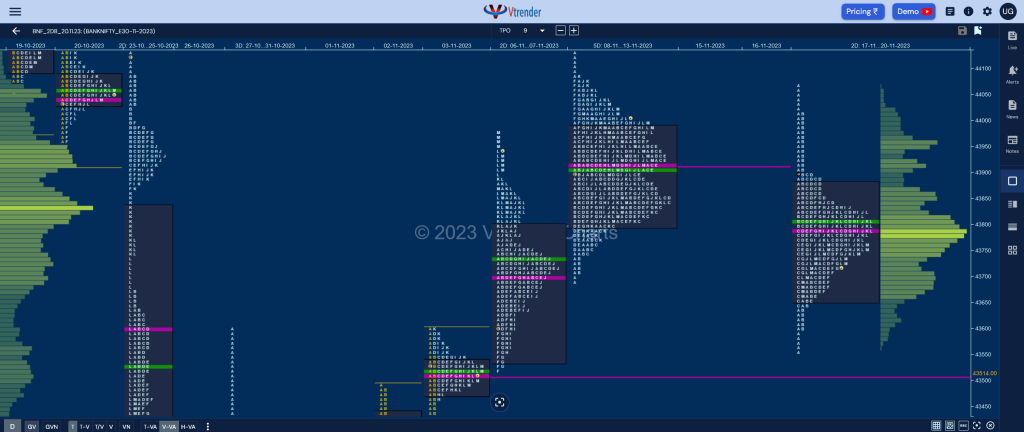

BankNifty Nov F: 43742 [ 43900 / 43559 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 14,490 contracts |

| Initial Balance |

|---|

| 165 points (43724 – 43559) |

| Volumes of 25,840 contracts |

| Day Type |

|---|

| Normal Variation – 340 points |

| Volumes of 99,512 contracts |

BNF opened with a probe below previous lows even taking out 07th Nov’s SOC (Scene Of Crime) of 43625 but took support just above that day’s VPOC of 43555 as it made a low of 43559 where it got some buying coming in which got it back into Friday’s range and balanced Value triggering the 80% Rule.

The auction went on to swipe through previous Value with the help of a big C side extension to 43899 and saw profit booking by the longs right at the PBH reference of 43891 which was also seen in an HVN forming at 43884 as even the D TPO made similar highs marking the end of the upside for the day and 80% Rule being played out on the downside as it made a low of 43655 in the E period.

BNF then remained in a narrow range for the rest of the day staying above the POC of 43679 and making multiple highs around Friday’s VWAP of 43840 leaving yet another balanced profile with overlapping Value and a small tail at lows which gives us a 3-1-3 Gaussian Curve on the 2-day composite with the Value at 43653-43789-43881 and it remains to be seen if it continues to build on this balance or makes a move away on initiative activity and higher volumes in the coming session(s).

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43679 F and VWAP of the session was at 43743

- Value zones (volume profile) are at 43599-43679-43801

- HVNs are at 42928 / 43184 / 43832** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 21st Nov 2023

| Up |

| 43774 – L TPO VWAP (20 Nov) 43884 – C & D TPO POC (20 Nov) 44010 – Selling Tail (17 Nov) 44082 – Weekly VWAP 44152 – Singles mid (17 Nov) |

| Down |

| 44723 – M TPO POC (20 Nov) 43605 – Buying Tail (20 Nov) 43514 – VPOC from 03 Nov 43423 – Gap mid-point (03 Nov) 43304 – VPOC from 02 Nov |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.