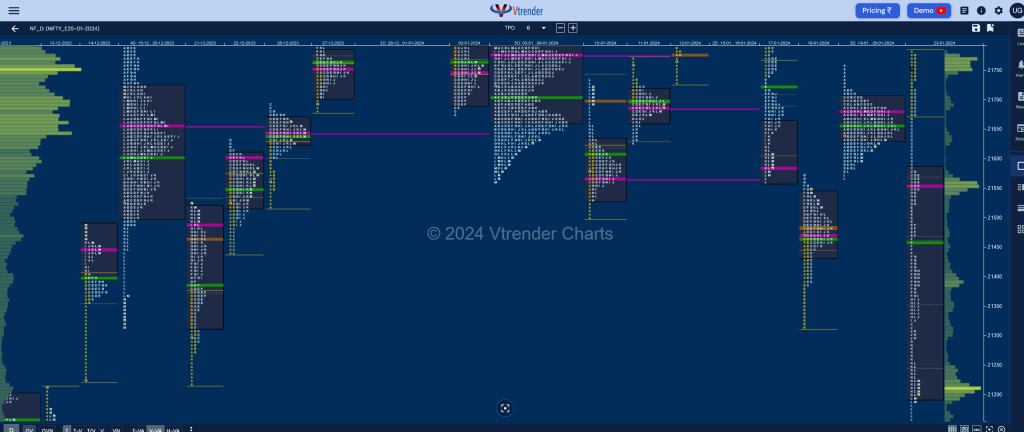

Nifty Jan F: 21194 [ 21783 / 21153 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 27,290 contracts |

| Initial Balance |

|---|

| 142 points (21783 – 21670) |

| Volumes of 52,876 contracts |

| Day Type |

|---|

| Trend – 630 points |

| Volumes of 2,52,641 contracts |

NF opened with a 156 point gap up even looking above the 2-day composite selling tail as it made a high of 21783 but could not sustain and attracted fresh supply at the previous week’s NeuX VWAP of 21768 as it left an extension handle at 21735 in the B period getting back into the 2-day Value and followed it with a big C side RE (Range Extension) with the second extension handle of the day at 21670 as it not only completed the 80% Rule but went on to negate the buying tail of the composite.

The auction then made a fresh RE in the D TPO as it entered 18th Jan’s Value and saw more aggressive selling coming in as could be seen in form of 2 more extension handles at 21525 & 21471 in the E & F periods respectively helping it not only completing the 3 IB target of 21444 but also getting into the initiative buying tail from 21388 to 21316.

NF then went on to make new lows for the series leaving the 5th extension handle of the day at 21325 in the J TPO which was followed by another one at 21295 in the K as it went on to negate the twin A period buying tails from 21220 (14th & 21st Dec) while making a low of 21194 and completed the Trend Day with the last RE down to 21153 in the L period and saw some profit booking into the close as it build volumes at 21210.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21557 F and VWAP of the session was at 21458

- Value zones (volume profile) are at 21192-21557-21587

- NF confirmed a FA at 22138 on 16/01 and completed the 2 ATR target of 21770 on 17/01

- HVNs are at 21662** / 21755 / 21890 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (12-18 Jan) – NF began with an initiative move away from previous week’s Value to the upside even scaling above the Jan RO (Roll Over) point of 21930 as it went on to make a high of 21995 on 12th and followed it up with new ATH of 22150 on 15th Jan but struggled to make a meaningful extension on the upside indicating exhaustion coming in and more confirmation of this came on the 16th where it left a FA at 22138 and formed a Neutral Centre profile from where the auction gave a trending move lower to 21316 over the last 2 days but left a buying tail till 21388 forcing profit booking as the weekly POC shifted down to 21469 leaving an elongated 833 point Neutral Extreme profile giving both new highs & lows for the series with overlapping to lower Value at 21320-31469-21694 with the NeuX VWAP at 21768 which will be the swing reference for the rest of the series

- (05-11 Jan) – NF has formed a Normal Variation profile to the downside which made a look down below previous lows but left an initaitive buying tail on the daily timeframe from 21528 to 21501 forming a nice balance over the 5 days with Value being completely inside at 21635-21703-21797 and this week’s VWAP also around the middle at 21690 where it closed and will need initiative volumes at one end in the coming week for a fresh imbalance to begin

- (29 Dec-04 Jan) – NF has formed a Neutral Centre weekly profile as it made a look up above previous highs but got rejected after making new ATH of 22025 and went on to make a low of 21579 taking support right above last week’s lower TPO HVN of 21570 filling up the low volumes zones and forming mostly overlapping Value at 21640-21748-21875 with a point to note that the sellers who had come in forming a base at 21890 had mostly booked profits at lower levels where it saw some short covering and fresh demand coming back.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 21930

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

Business Areas for 24th Jan 2024

| Up |

| 21210 – Closing HVN (23 Jan) 21255 – Mid-profile singles (23 Jan) 21294 – Ext Handle (23 Jan) 21325 – Ext Handle (23 Jan) 21372 – H TPO halfback |

| Down |

| 21189 – Closing tail (23 Jan) 21148 – SOC from 13 Dec 21104 – VWAP from 13 Dec 21074 – VPOC from 13 Dec 21014 – VPOC from 05 Dec |

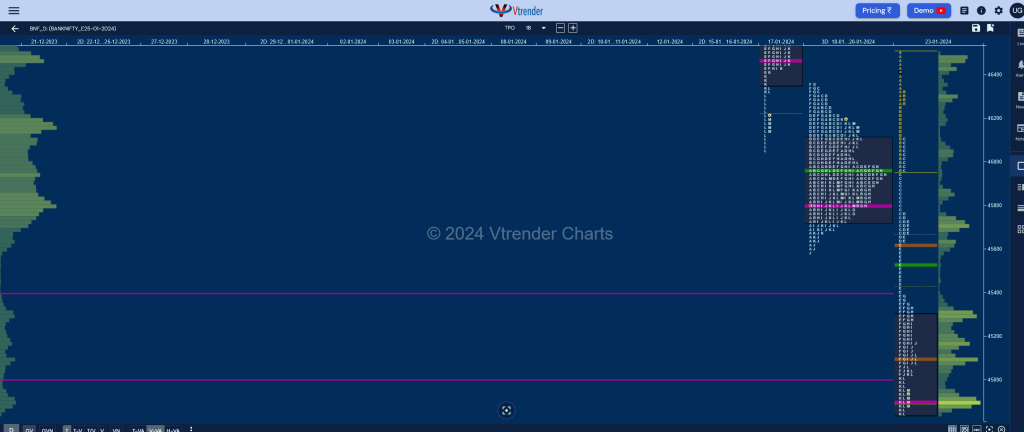

BankNifty Jan F: 44913 [ 46525 / 44835 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 19,091 contracts |

| Initial Balance |

|---|

| 560 points (46525 – 45965) |

| Volumes of 57,326 contracts |

| Day Type |

|---|

| Trend – 1690 points |

| Volumes of 2,47,350 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44903 F and VWAP of the session was at 45537

- Value zones (volume profile) are at 44840-44903-45296

- BNF confirmed a FA at 45760 on 20/01 and completed the 1 ATR objective of 46396 on 23/01 but went on to revisit on same day

- BNF confirmed a FA at 46337 on 19/01 and the completed the 1 ATR objective of 45928 on same day. This FA got revisited in the gap up open on 23/01

- BNF confirmed a FA at 48440 on 16/01 and the completed the 2 ATR objective of 47386 on 17/01

- HVNs are at 47956 / 48007 / 48157** / 48555 (** denotes series POC)

Weekly Zones

- (11-17 Jan) – BNF made a slow and trending move higher for the first 4 days of the week getting above previous week’s VWAP of 47970 but marked the end of the upside with a daily FA at 48440 on 16th leaving a nice 2-day balance from where it made a big move away on the last day making it a hat-trick of Neutral Extreme weekly profiles to the downside re-confirming the lack of demand at the upper levels forming the biggest weekly range of the current series of 2389 points with mostly overlapping Value at 47110-48233-48432 with the NeuX VWAP at 47458

- (04-10 Jan) – BNF has once again formed a Neutral Extreme Down weekly profile which first filled up the low volume zone of previous week and then went on repair the poor lows with a sharp move lower testing the swing lows of 47303 (21-28 Dec) while tagging 47201 before giving a bounce back to 47666 into the close. Value for the week was completely overlapping at 47670-48076-48601 with the main supply reference being at the NeuX VWAP of 47970

- (29 Dec-03 Jan) – BNF has formed a Neutral Extreme which also reresents a Double Distribution Trend Down profile which got stalled right below previous week’s POC of 48879 on the upside and went on to fill the low volume zone till 48446 and made an initiative move with a small selling tail from 48346 to 48256 as it went on to make poor lows at 47763 forming a lower balance with the POC also shifting down to 47956. Value for the week was at 47765-47956-48542 with the important DD VWAP being at 48278 which will be the swing reference for the coming settlement.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 48900

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

Business Areas for 24th Jan 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.