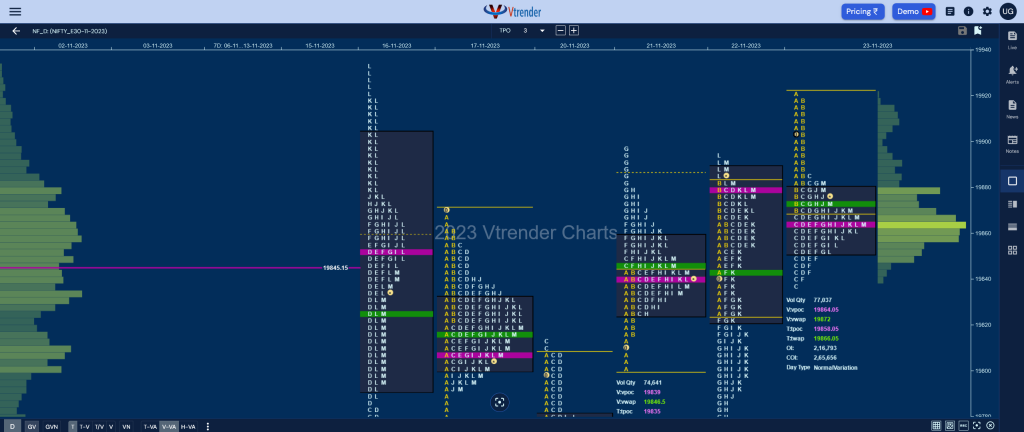

Nifty Nov F: 19868 [ 19922 / 19838 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 7,393 contracts |

| Initial Balance |

|---|

| 52 points (19922 – 19869) |

| Volumes of 18,746 contracts |

| Day Type |

|---|

| Normal Variation – 84 points |

| Volumes of 77,037 contracts |

NF opened higher and took support just above yPOC of 19879 as it made a low of 19882 and then went on to test 16th Nov’s mini selling tail from 19919 to 19936 as it hit 19922 in the A period but could not extend any further as the B TPO left a small selling tail at top along with new lows of 19869.

The auction then made a good C side extension lower as it tested the NeuX VWAP of 19843 while making a low of 19838 which was held for the rest of the day as it formed a balance staying inside the C period range in all the remaining TPOs building a prominent POC at 19864 where it eventually closed leaving a ‘b’ shape profile for the day with completely inside Value.

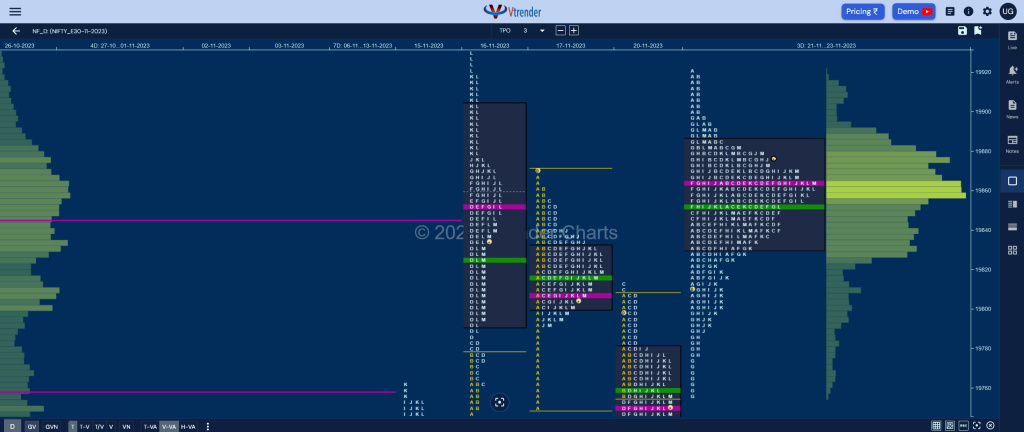

NF spent yet another day in the 16th Nov Trend Day profile but instead of the 6-day composite, we can look at the last 3-day balance which has formed just above 20th Nov’s VPOC of 19750 giving a perfect Gaussian Curve with Value at 19831-19864-19884 and looks set to start a fresh imbalance in the coming session(s). (Click here to view the composite only on Vtrender Charts)

Click here to view the latest profile in NF on Vtrender Charts

Weekly Settlement (17th to 23rd Nov) : 19868 [ 19922 / 19718 ]

NF has formed a narrow 204 point range inside bar this week staying above last week’s POC of 19688 as it made a low of 19718 and filled up the upper part of previous week’s profile forming a nice balance with completely inside Value at 19799-19863-19884 and closed right at the prominent POC suggesting that a fresh imbalance could be about to start not just on the daily timeframe but also on the weekly one.

Daily Zones

- Largest volume (POC) was traded at 19864 F and VWAP of the session was at 19872

- Value zones (volume profile) are at 19852-19864-19880

- NF confirmed a FA at 19385 on 06/11 and tagged the 2 ATR objective of 19704 on 15/11

- HVNs are at 19129 / 19213 / 19486** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 24th Nov 2023

| Up |

| 19884 – 3-day VAH (21-23 Nov) 19917 – Selling Tail (23 Nov) 19940 – 1 ATR from 19832 19976 – Swing High (17 Oct) 20007 – SOC from 22 Sep |

| Down |

| 19863 – dPOC from 23 Nov 19818 – SOC from 22 Nov 19778 – Buying tail (22 Nov) 19750 – VPOC (20 Nov) 19718 – Swing Low (20 Nov) |

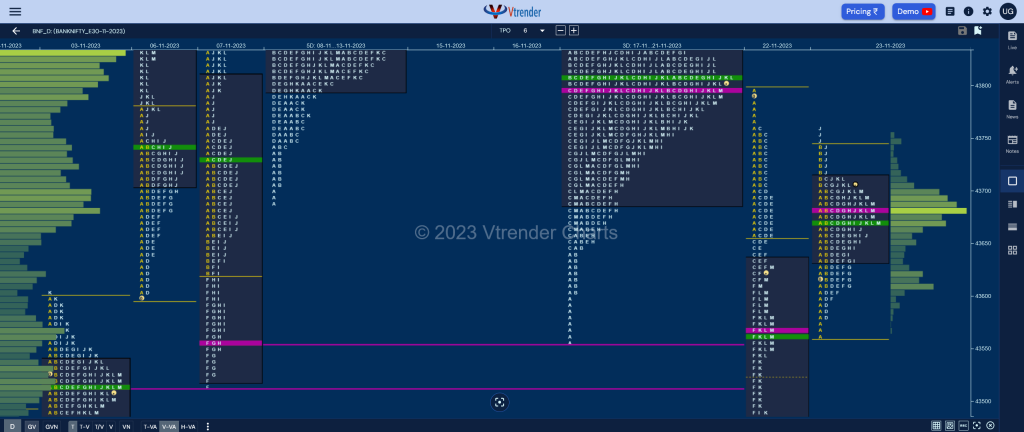

BankNifty Nov F: 43690 [ 43758 / 43562 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 8,088 contracts |

| Initial Balance |

|---|

| 178 points (43740 – 43562) |

| Volumes of 21,538 contracts |

| Day Type |

|---|

| Normal – 196 points |

| Volumes of 67,336 contracts |

BNF made a quiet OAIR start and took support right at previous day’s POC of 43569 making a low of 43562 and probing higher for the rest of the Initial Balance (IB) as it made a high of 43740 leaving small tails at both ends after which the C side made a rare inside bar indicating that theme for the day was a balance.

The auction then tested the buying tail while leaving a PBL at 43581 in the D period and made a slow probe higher even making a RE (Range Extension) to the upside in the J TPO but could only manage 43758 stalling right below yesterday’s A period singles giving a retracement back to day’s VWAP before closing at the dPOC of 43684.

BNF has formed a Normal Day and a balance between 22nd Nov’s POC of 43569 and the selling tail from 43760 so will need to take out one of the extremes in the coming session(s) for a fresh imbalance in that direction with the FA of 43897 being an important swing reference on the upside.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43684 F and VWAP of the session was at 43668

- Value zones (volume profile) are at 43636-43684-43710

- BNF confirmed a FA at 43897 on 21/11 and tagged 1 ATR objective of 43544 on 22/11. The 2 ATR target on the downside comes to 43191

- HVNs are at 42928 / 43184 / 43832** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 24th Nov 2023

| Up |

| 43740 – Selling Tail (23 Nov) 43834 – Weekly DD VWAP 43920 – B TPO VWAP (17 Nov) 44010 – Selling Tail (17 Nov) 44124 – 1 ATR from VPOC (43803) |

| Down |

| 43668 – Closing PBL (23 Nov) 43581 – Buying Tail (23 Nov) 43488 – SOC from 22 Nov 43395 – Buying tail (22 Nov) 43304 – VPOC from 02 Nov |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.