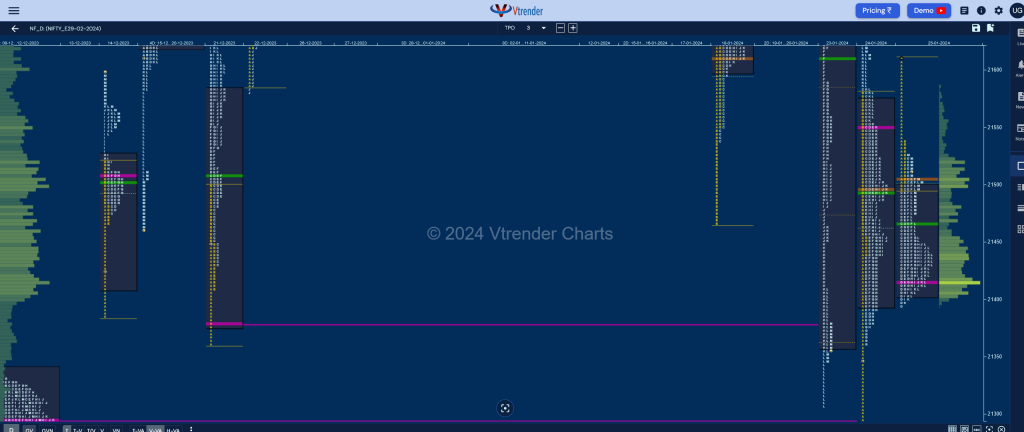

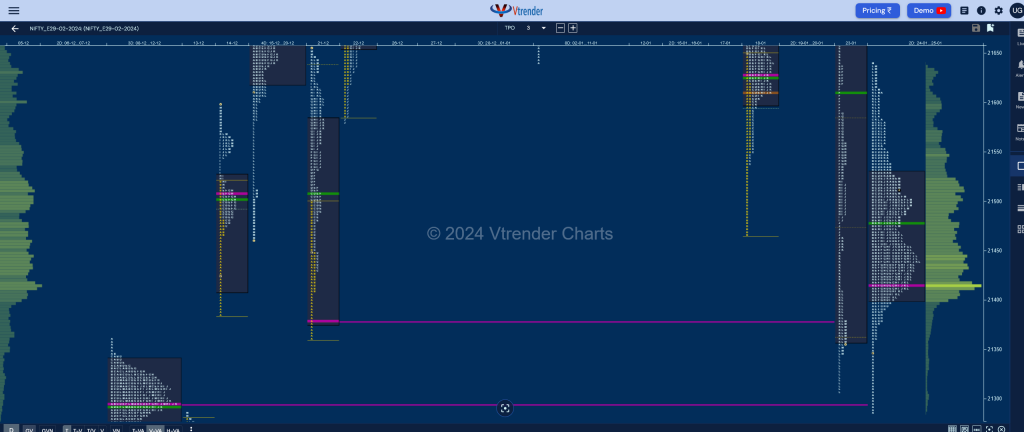

Nifty Feb F: 21488 [ 21611 / 21394 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 13,510 contracts |

| Initial Balance |

|---|

| 115 points (21611 – 21496) |

| Volumes of 34,569 contracts |

| Day Type |

|---|

| Normal Variation – 217 points |

| Volumes of 1,84,170 contracts |

NF not only rejected the previouse spike close from 21582 to 21640 but made an OH (Open=High) start at 21611 probing lower as it broke below the yPOC of 21549 while making a low of 21496 in the B TPO and continued to fall making a big C side extension to 21431 leaving an initiative selling tail from 21539 to 21611.

The auction continued the downside move in the D period hitting new lows of 21394 but saw some demand coming back at previous VAL as it left couple of PBLs at 21401 & 21396 and in the process even shifting the dPOC lower to 21414 indicating that the sellers were booking out and seemed like will end up leaving a ‘b’ shape profile for the day.

However, NF saw some short covering happening in the L & M TPOs as it got back above day’s VWAP and went on to hit 21525 leaving an Inside Day both in terms of range and value and with opposing A period singles with the 2-day composite at 21400-21416-21530 hence will need to negate one of the tails as the new series gets underway for a move in that direction.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21414 F and VWAP of the session was at 21467

- Value zones (volume profile) are at 21402-21414-21498

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Jan) – NF has formed a Neutral Extreme weekly profile in a relatively large range of 21916 to 21287 with mostly lower Value at 21349-21416-21583 and also represents a Double Distribution shape with the upper HVN at 21804 and a small zone of singles in the middle of the profile from 21640 to 21670 seperating the lower distribution where it has also left a small buying tail at a prior weekly VPOC of 21296 (08-14 Dec) which will be the support zone for the coming week whereas on the upside, this week’s VWAP of 21540 will need to taken out and sustained for a move towards 21804 and the mini tail from 21908

Monthly Zones

- The settlement day Roll Over point (February 2024) is 21419

- The VWAP & POC of Jan 2024 Series is 21575 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

Business Areas for 29th Jan 2024

| Up |

| 21505 – Closing HVN (25 Jan) 21555 – A TPO POC (25 Jan) 21610 – SOC from 24 Jan 21671 – Ext Handle (23 Jan) 21703 – VPOC from 23 Jan |

| Down |

| 21460 – L TPO VWAP (25 Jan) 21414 – dPOC from 25 Jan 21360 – Buying Tail (24 Jan) 21323 – A TPO POC (24 Jan) 21270 – HVN from 13 Dec |

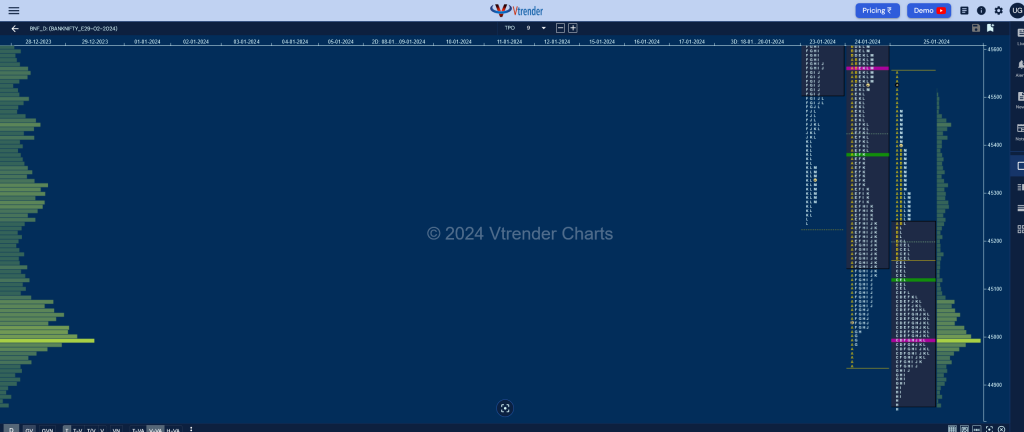

BankNifty Feb F: 45291 [ 45556 / 44851 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 15,778 contracts |

| Initial Balance |

|---|

| 386 points (45556 – 45170) |

| Volumes of 40,110 contracts |

| Day Type |

|---|

| Normal Variation – 705 points |

| Volumes of 2,79,285 contracts |

BNF made an OAIR with an almost OH (Open=High) start just below the yPOC of 45560 indicating that the sellers were back in control and the previous close was just a short covering bounce and more confirmation of this came in form of big C side extension to PDL of 44940 from where it gave the typical retracement to day’s VWAP even scaling above it in the E period but got rejected at the IBL of 45170 as it left a PBH at 45192.

The auction then made couple of fresh REs (Range Extension) to the downside in the G & H TPOs but could only manage to tag 44851 signalling exhaustion after which it began to form a balance building volumes at 44999 till the K period but a swipe above day’s VWAP in the L triggered a quick short covering bounce to 45473 leaving a Normal Variation Day with mostly lower Value but closing well above VAL.

BNF starts the new series with the Roll Over point at 44999 which will be the reference as inventory starts to build up in the first few sessions with January’s series VWAP of 46488 being an important swing reference to watch on the upside along with the monthly POC of 48119.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44999 F and VWAP of the session was at 45125

- Value zones (volume profile) are at 44861-44999-45239

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Jan) – BNF has also formed a Neutral Extreme weekly profile in a range of 46892 to 44851 with completely lower Value at 44903-44997-45626 but has seen the POC shift to the lows hinting at profit booking by sellers so can give a bounce with this week’s VWAP of 45492 being an important reference for the buyers to take out in case of the upmove to continue in the new series

Monthly Zones

- The settlement day Roll Over point (February 2024) is 44999

- The VWAP & POC of Jan 2024 Series is 46488 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

Business Areas for 29th Jan 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.