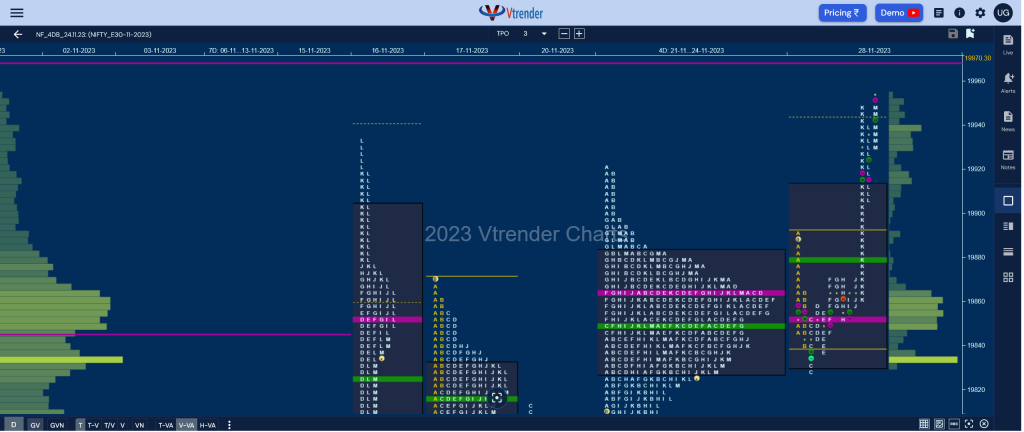

Nifty Nov F: 19936 [ 19955 / 19827 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 7,938 contracts |

| Initial Balance |

|---|

| 25 points (19865 – 19840) |

| Volumes of 18,978 contracts |

| Day Type |

|---|

| Neutral Extreme – 127 points |

| Volumes of 1,05,973 contracts |

NF made a freak tick of 19890 at open but remained mostly below the 4-day composite POC of 19863 as it formed an ultra narrow range of just 25 points between 19865 & 19840 in the Initial Balance which was followed by a C side extension lower where it tagged the composite VAL of 19828 to the dot and found some demand coming back as it left a small responsive buying tail.

The auction then consolidated while staying above the IBL and left a PBL at 19838 in the E period after which it made marginal new highs of 19870 in the F TPO but found responsive sellers as it went on to mark similar highs in the G,H & J periods too but remained above day’s VWAP indicating that the buyers had a slight advantage which was also seen in the FA (Failed Auction) being confirmed at day’s low.

The K period then made a killer move to the upside not only leaving an extension handle at 19870 but went on to complete the 1 ATR objective of 19931 from the FA signalling the start of a fresh imbalance while making a high of 19949 after which it gave a small dip to 19905 in the L TPO but as the day’s structure was that of a Neutral Extreme (NeuX), NF went on to make new highs of 19955 in the M. The NeuX zone low of 19929 along with VWAP of 19880 which coincides with the composite VAH will be the swing references for the next 2 sessions as the current series looks to close at new highs.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19854 F and VWAP of the session was at 19880

- Value zones (volume profile) are at 19832-19854-19912

- NF confirmed a FA at 19827 on 28/11 and tagged the 1 ATR objective of 19931 on the same day. The 2 ATR target comes to 20034

- NF confirmed a FA at 19385 on 06/11 and tagged the 2 ATR objective of 19704 on 15/11

- HVNs are at 19129 / 19213 / 19486** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 29th Nov 2023

| Up |

| 19955 – NeuX High (28 Nov) 20007 – SOC from 22 Sep 20049 -H TPO POC (22 Sep) 20086 – Selling Tail (21 Sep) 20123 – IB tail mid (21 Sep) |

| Down |

| 19929 – NeuX Low (28 Nov) 19880 – NeuX VWAP (28 Nov) 19852 – PBL from 28 Nov 19809 – Buying Tail (24 Nov) 19750 – VPOC (20 Nov) |

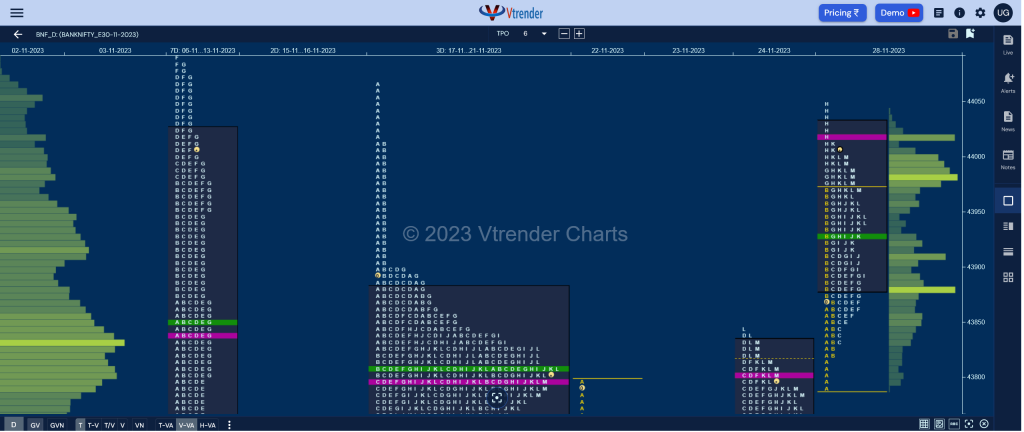

BankNifty Nov F: 43984 [ 44048 / 43791 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 7,406 contracts |

| Initial Balance |

|---|

| 139 points (43930 – 43791) |

| Volumes of 26,870 contracts |

| Day Type |

|---|

| Normal Variation – 257 points |

| Volumes of 1,03,480 contracts |

BNF opened above previous high of 43845 but could only manage to hit 43869 where lack of fresh demand pushed it back into previous range where it tagged the yPOC of 43800 while making a low of 43791 and got some demand coming back which could be seen in the singles it left at the start ofthe B period which then caused a short covering swipe to 43930 as it tested the supply zone from 17th Nov. (P.S: A freak tick of 43969 was recorded in the B but OrderFlow did not show any volumes above 43930)

The auction then formed a rare inside bar in the C side and continued to coil within it till the F TPO but importantly stayed above day’s VWAP and made a fresh move to the upside in the G period and followed it with new highs of 44048 in the H almost completing the 2 IB target for the day.

However, BNF saw the dPOC shift higher to 44019 indicating profit booking by the longs and this triggered a pull back to the day’s VWAP in the I TPO where it left an important PBL at 43893 marking the return of buyers who then pushed it higher to 44013 in the K period but was unable to get above the dPOC forming a mini consolidation into the close forming a HVN at 43980 where it eventually closed leaving a 3-1-3 profile for the day with completely higher Value negating tge 21st Nov FA of 43897 so as long as it remains above it PLR would be to the upside.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44019 F and VWAP of the session was at 43928

- Value zones (volume profile) are at 43883-44019-44029

- BNF confirmed a FA at 43897 on 21/11 and tagged 1 ATR objective of 43544 on 22/11. The auction closed above this FA on 28/11 hence negating this as a sell side reference

- HVNs are at 42928 / 43184 / 43832** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 29th Nov 2023

| Up |

| 44019 – dPOC from 28 Nov 44124 – 1 ATR from VPOC (43803) 44262 – HVN from 16 Nov 44382 – VWAP from 16 Nov 44459 – VPOC from 16 Nov |

| Down |

| 43980 – Closing HVN (28 Nov) 43850 – PBL from 28 Nov 43724 – I TPO POC (24 Nov) 43616 – Buying Tail (24 Nov) 43488 – SOC from 22 Nov |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.