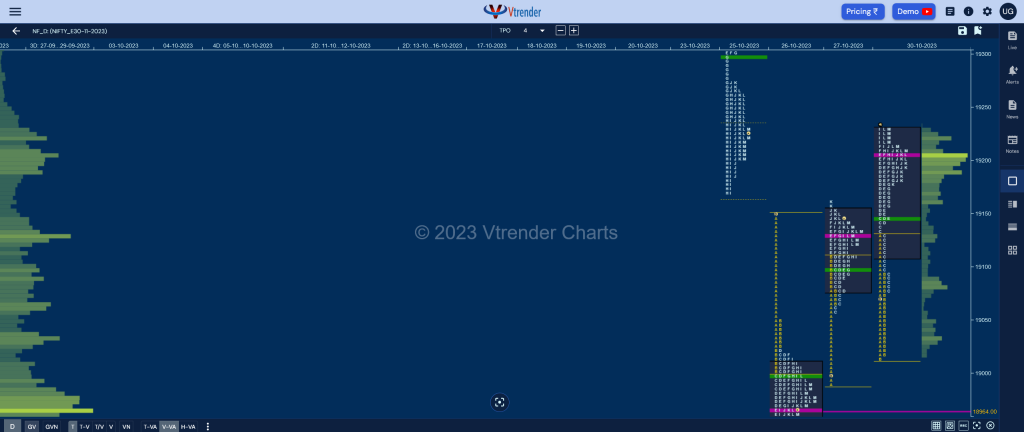

Nifty Nov F: 19221 [ 19234 / 19014 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 14,386 contracts |

| Initial Balance |

|---|

| 115 points (19130 – 19014) |

| Volumes of 36,233 contracts |

| Day Type |

|---|

| Double Distribution (DD) – 220 points |

| Volumes of 1,21,659 contracts |

NF made another OAIR start probing lower in the A period as it entered previous session’s initiative buying tail from 19056 to 18990 and made a low of 19017 and started the B TPO with marginal new lows of 19014 but could not sustain triggering a bounce back to 19094 which was followed by a C side extension to 19145 confirming change of PLR (Path of Least Resistance) to the upside.

The auction continued making higher highs till the F period starting with another extension handle in the D as it tagged 19214 after which it made a retracement down to 19158 in the G TPO leaving a PBL there before making fresh REs (Range Extension) in the I & M periods hitting new highs of 19234 into the close leaving a Double Distribution Trend Day Up.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19204 F and VWAP of the session was at 19147

- Value zones (volume profile) are at 19108-19204-19231

- HVNs are at 19062 / 19129 / 19392 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19568 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 31st Oct 2023

| Up |

| 19234 – Spike high (30 Oct) 19275 – PBH (25 Oct) 19326 – G TPO POC (25 Oct) 19357 – Ext Handle (25 Oct) 19392 – VPOC from 25 Oct |

| Down |

| 19208 – Spike low (30 Oct) 19178 – PPL (30 Oct) 19130 – DD Ext Handle (30 Oct) 19094 – SOC (30 Oct) 19048 – B TPO VWAP (30 Oct) |

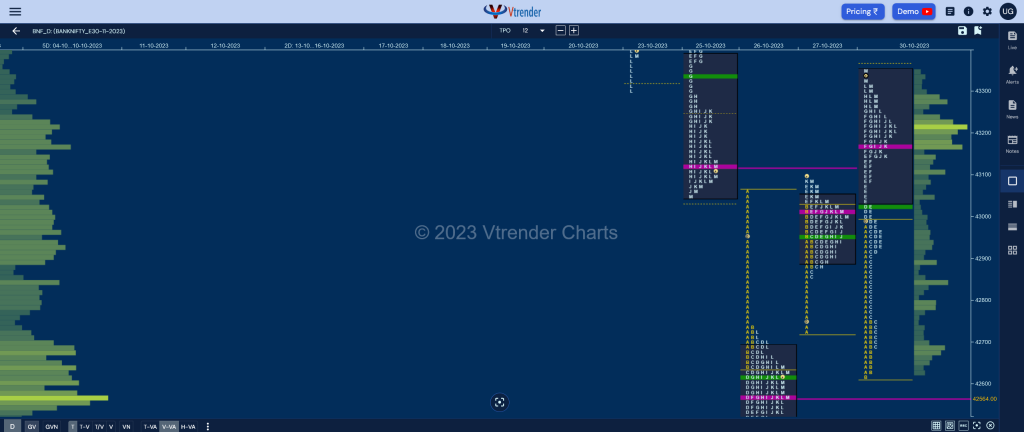

BankNifty Nov F: 43295 [ 43350 / 42623 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 18,698 contracts |

| Initial Balance |

|---|

| 371 points (42994 – 42623) |

| Volumes of 45,629 contracts |

| Day Type |

|---|

| Double Distribution (DD) – 727 points |

| Volumes of 1,82,551 contracts |

BNF opened below previous session’s POC of 43014 and made a drive like open as it completely negated the buying singles from 42860 to 42730 and went on to enter 26th Oct’s Value area as it made a low of 42635 in the A period triggering the 80% rule and began the B TPO hitting new lows of 43623 but could not take out that day’s VWAP of 43622 indicating lack of supply.

The auction then saw the buyers taking control by first leaving a SOC (Scene Of Crime) at 42750 not only getting back above the day’s VWAP but went on to make multiple REs to the upside confirming an extension handle at 43030 as it not only tagged the 25th Oct’s VPOC of 43119 but went on to tag the DD VWAP of 43337 of that day while making a small spike higher to 43350 into the close leaving a Double Distribution Trend Day Up.

Value was mostly higher so today’s spike low of 43270 along with dPOC & VWAP of 43171 & 43027 respectively will be the important references on the downside for the coming session(s) whereas on the upside, BNF will have to sustain above 25th Oct’s VWAP of 43337 for a probe towards 43461, 43563 & 43637 in the coming session(s).

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43171 F and VWAP of the session was at 43027

- Value zones (volume profile) are at 43039-43171-43349

- HVNs are at 42929 / 44040 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43860 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 31st Oct 2023

| Up |

| 43337 – DD VWAP (25 Oct) 43461 – LVN (25 Oct) 43560 – SOC (25 Oct) 43637 – Selling Tail (25 Oct) 43784 – TD VWAP (23 Oct) |

| Down |

| 43270 – Spike low (30 Oct) 43171 – dPOC (30 Oct) 43030 – Ext Handle (30 Oct) 42898 – C TPO POC (30 Oct) 42750 – SOC from 30 Oct |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.