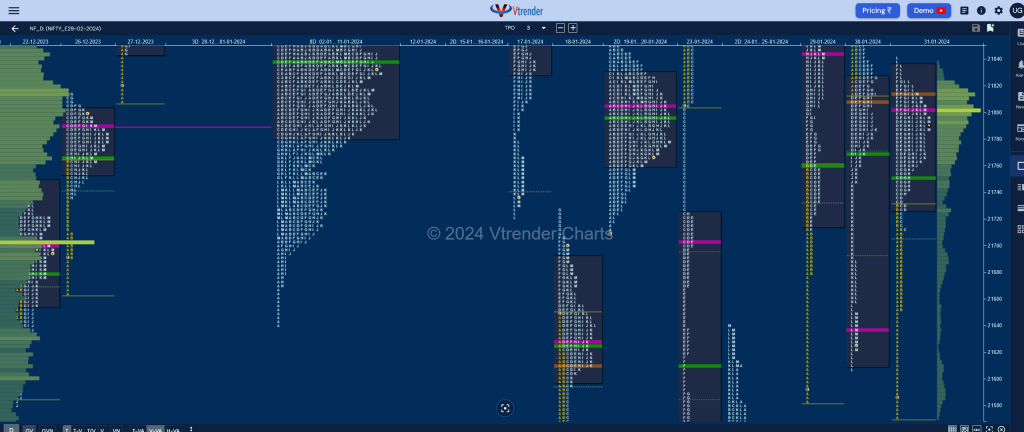

Nifty Feb F: 21808 [ 21840 / 21570 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 15,838 contracts |

| Initial Balance |

|---|

| 160 points (21729 – 21570) |

| Volumes of 38,629 contracts |

| Day Type |

|---|

| Normal Variation – 270 points |

| Volumes of 1,46,625 contracts |

NF gave a follow down to previous session’s imbalance close even breaking below the 29th Jan’s A period low of 21575 but could only manage to tag 21570 and confirmed an ORR (Open Rejection Reverse) resulting in a trending move till the F TPO where it hit 21834.

The auction then settled down into a balance for the rest of the day taking support at day’s VWAP as it left a PBL (Pull Back Low) at 21740 in the H period and made marginal new highs of 21840 into the close leaving a ‘p’ shape profile with a close around the dPOC of 21804 and overlapping value for the third consecutive day.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21804 F and VWAP of the session was at 21750

- Value zones (volume profile) are at 21728-21804-21834

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Jan) – NF has formed a Neutral Extreme weekly profile in a relatively large range of 21916 to 21287 with mostly lower Value at 21349-21416-21583 and also represents a Double Distribution shape with the upper HVN at 21804 and a small zone of singles in the middle of the profile from 21640 to 21670 seperating the lower distribution where it has also left a small buying tail at a prior weekly VPOC of 21296 (08-14 Dec) which will be the support zone for the coming week whereas on the upside, this week’s VWAP of 21540 will need to taken out and sustained for a move towards 21804 and the mini tail from 21908

Monthly Zones

- The settlement day Roll Over point (February 2024) is 21419

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

Business Areas for 01st Feb 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

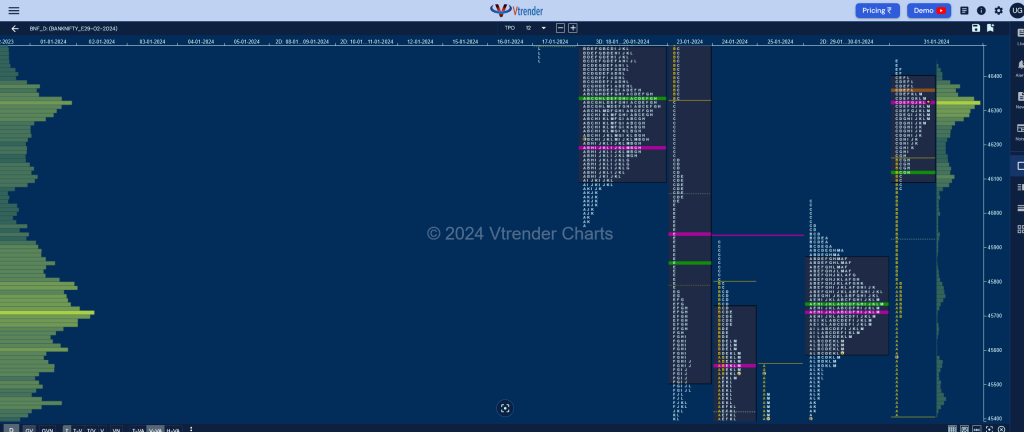

BankNifty Feb F: 46324 [ 46444 / 45405 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 16,354 contracts |

| Initial Balance |

|---|

| 757 points (46162 – 45405) |

| Volumes of 48,777 contracts |

| Day Type |

|---|

| DD Trend – 1039 points |

| Volumes of 2,59,659 contracts |

BNF opened lower and made an attempt to move away from the 2-day balance even making a look down below previous lows of 45422 as it recorded new lows for the series at 45405 but did not find any fresh supply bring back aggressive buyers who then not only swiped through the Gaussian Curve in the IB (Initial Balance) where it went on to climb higher by 757 points but made a big C side extension to 46397 testing 23rd Jan’s selling extension handle.

The auction then made a fresh RE in the E period where it hit 46444 but could not extend any further as the imbalance of the first half then turned into a balance for the rest of the day with a retracement to day’s VWAP in the G TPO giving a PBL at 46122 triggering a bounce back to 46400 into the close leaving a Double Distribution Trend Day up with completely higher value but the dPOC shifting to 46324 where it exaclty closed.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 46324 F and VWAP of the session was at 46125

- Value zones (volume profile) are at 46093-46324-46394

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (29-31 Jan) – BNF took support multiple times at previous week’s VWAP of 45492 forming a Neutral Extreme weekly profile to the upside giving a move away from the prominent POC of 45717 on the last day where it went on to hit new highs of 46444 forming overlapping to higher Value at 46429-45717-45994 but this week’s NeuX VWAP of 45883 will be the important reference going forward if it has to continue higher towards the selling tail from 46720 & extension handle of 47115 in the coming week

- (19-25 Jan) – BNF has also formed a Neutral Extreme weekly profile in a range of 46892 to 44851 with completely lower Value at 44903-44997-45626 but has seen the POC shift to the lows hinting at profit booking by sellers so can give a bounce with this week’s VWAP of 45492 being an important reference for the buyers to take out in case of the upmove to continue in the new series

Monthly Zones

- The settlement day Roll Over point (February 2024) is 44999

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

Business Areas for 01st Feb 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.