Nifty Oct F: 11162 [ 11262 / 11148 ]

HVNs – 11150 / 11240 / (11270) / [11362] / 11400 / 11480 / 11550

Friday’s report ended with this ‘The auction has closed in an imbalance so can expect the same to continue at open in the next session before balance returns’ and though NF opened slightly higher, it got immediately sold into as it made a quick fall breaking below previous week lows and went on to tag 11157 in the opening 10 minutes tagging the important level of 11178 which was the Trend Day VWAP of that big day of 20th September and the probable objective of this imbalance down. The auction then made a swift reversal in the ‘A’ period itself as it got back into Friday’s range to give a late ORR (Open Rejection Reverse) and went on to scale above morning highs and continued to probe higher in the ‘B’ period as it hit 11260 falling just short of the yPOC of 11270 which was again an important reference on the upside. NF then made an attempt to make an RE (Range Extension) to the upside in the most dreaded ‘C’ period but got rejected at 11262 and made a probe lower over the next 2 periods as it broke below PDL (Previous Day Low) in the ‘D’ period and this time it got rejected after making a low of 11193 after which the auction stayed between these 2 rejections making a balance & forming a ‘p’ shape profile till the ‘K’ period but saw some liquidation happening in the last 45 minutes it spiked lower into the close breaking into the morning tail of 11193 to 11157 and went on to make new lows of 11148 once again closing in an imbalance more while confirming a FA (Failed Auction) at 11262 so there is good chance of this imbalance to continue in the open of next session.

(Click here to view this week’s action in NF)

- The NF Open was an Open Rejection Reverse – Up (ORR)

- The day type was a Normal Day

- Largest volume was traded at 11240 F

- Vwap of the session was at 11216 with volumes of 96.8 L and range of 114 points as it made a High-Low of 11262-11148

- NF confirmed a FA at 11262 on 07/10 and the 1 ATR move down comes to 11068

- NF has closed below the 20th Sep Trend Day VWAP of 11178

- The higher Trend Day VWAP of 05/07 at 11965 is an important reference higher.

- The settlement day Roll Over point (Oct) is 11630

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11188-11240-11254

Hypos / Estimates for the next session:

a) NF needs to sustain above 11173 for a probe higher to 11193 / 11210-215 & 11240

b) Immediate support is at 11142-127 below which the auction becomes weak for 11092-90 & 11068

c) Above 11240, NF can probe higher to 11255-270 / 11290 & 11310-320

d) Below 11068, auction becomes weak for 11022 & 10985-974

e) If 11320 is taken out, the auction go up to to 11335 / 11362-372 & 11400-406

f) Break of 10974 can trigger a move lower to 10958 & 10921

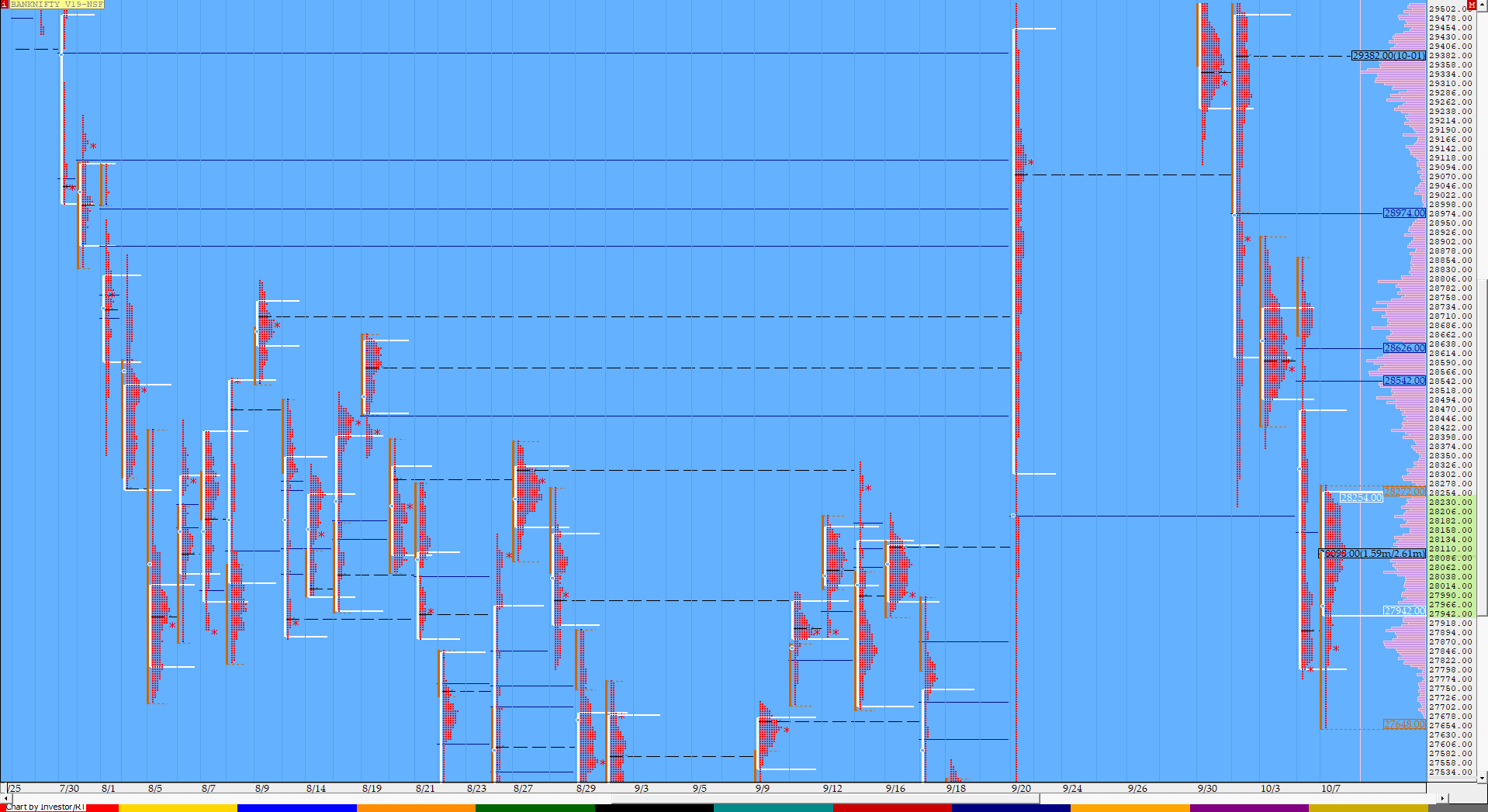

BankNifty Oct F: 27871 [ 28277 / 27652 ]

HVNs – 27860 / 28080 / 28300 / (28580) / 28690-725 / 29350-382

BNF opened higher but the almost OH (Open=High) start of 27950-27973 led to a big 300 point fall in the first 10 minutes as it broke below previous week’s low of 27778 and hit lows of 27652 where it was met with swift rejection which saw it make new day highs of 28010 in the ‘A’ period itself. The auction continued to probe higher in the ‘B’ period as it made highs of 28277 falling just short of the Friday’s Trend Day VWAP of 28284 and in the process left a huge IB (Initial Balance) range of 625 points which indicated that it could remain in this range for sometime attempting to balance after the recent imbalance to the downside. BNF then make a probe down in the ‘C’ & ‘D’ periods after the rejection below yVWAP making a low of 27917 holding just above the yPOC of 27900 after which the auction remained between these 2 levels forming a ‘p’ shape profile for the day but a late spike down in the ‘L’ period saw the morning tail of 27917 to 27652 being tested but unlike NF, BNF took support in the singles and made a low of 27810 before closing the day at 27871 leaving a Normal Day with Value being completely inside previous Value.

(Click here to view this week’s action in BNF)

- The BNF Open was an Open Rejection Reverse – Up (ORR)

- The day type was a Normal Day

- Largest volume was traded at 28098 F

- Vwap of the session was at 28049 with volumes of 42.9 L and range of 625 points as it made a High-Low of 28277-27652

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Oct) is 30230

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 27778-27900-28423

Hypos / Estimates for the next session:

a) BNF has immediate supply at 27905 above which it could rise to 27980 / 28050-090 / 28150 & 28205-225

b) Immediate support is at 27860 below which the auction could test 27810-780 / 27675-650 / 27570 & 27495

c) Above 28225, BNF can probe higher to 28275-284 / 28425-465 & 28551-590

d) Below 27495, lower levels of 27420 / *27352*-340 & 27157-135 could come into play

e) Sustaining above 28590, BNF can give a fresh move up to 28632-640 / 28700-730 / 28775 & 28830-850

f) Break of 27135 could trigger a move down 27065-027 / 26976-925 & 26840-830

Additional Hypos

g) Above 28850, higher levels of 28902-920 / 28976-982 & 29069 could get tagged

h) If 26830 is broken, BNF could fall to 26750 / 26700-690 & 26640-593

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout