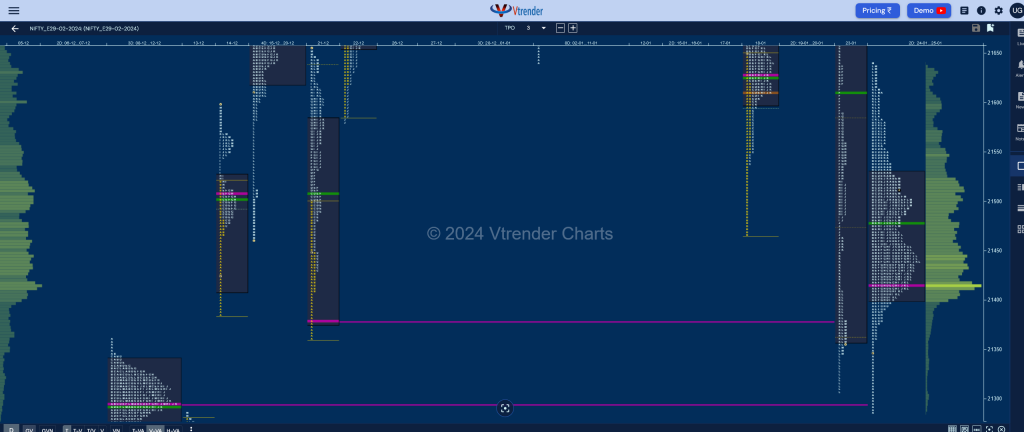

Market Profile Analysis dated 06th February 2024

Nifty Feb F: 21979 [ 22015 / 21790 ] Open Type OAIR (Open Auction In Range) Volumes of 13,245 contracts Below average Initial Balance 133 points (21923 – 21790) Volumes of 35,675 contracts Below average Day Type Double Distribution – 225 pts Volumes of 1,29,365 contracts Below average NF made an OAIR start but gave a […]

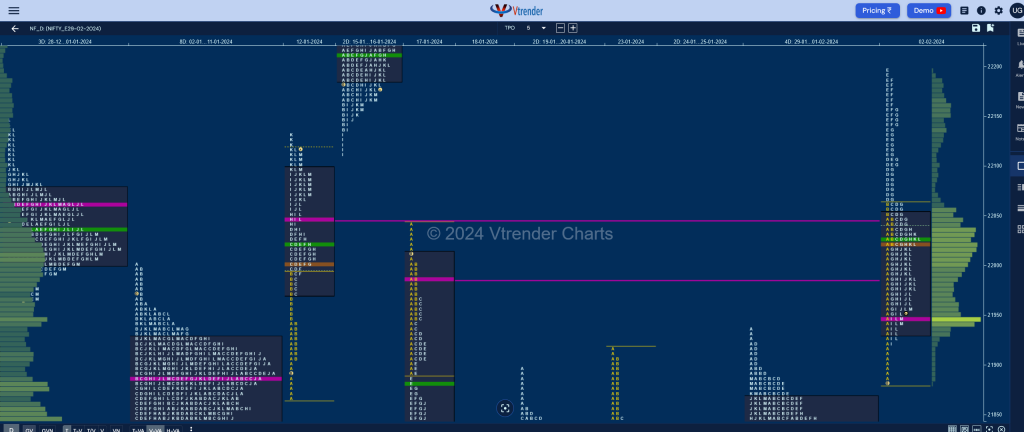

Market Profile Analysis dated 05th February 2024

Nifty Feb F: 21803 [ 22036 / 21765 ] Open Type OAIR (Open Auction In Range) Volumes of 15,350 contracts Below average Initial Balance 135 points (22036 – 21901) Volumes of 40,011 contracts Below average Day Type Normal Variation – 271 points Volumes of 1,58,291 contracts Average NF made an OAIR start taking support in the […]

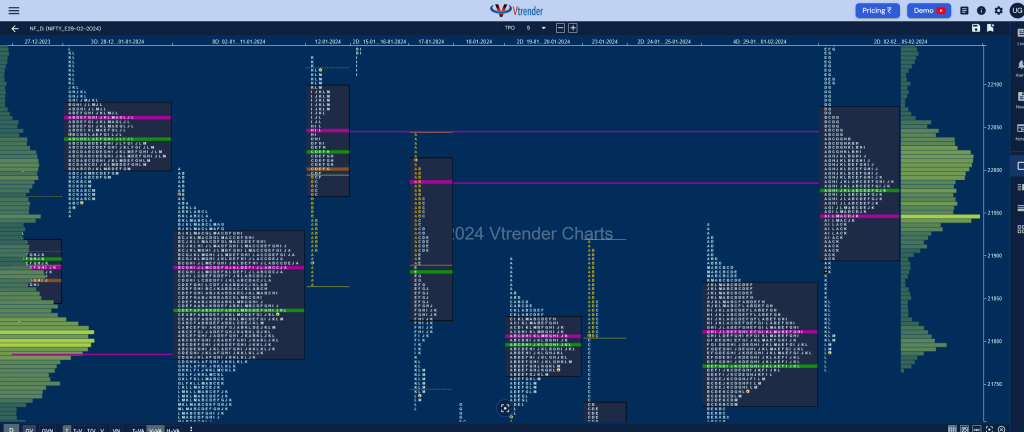

Market Profile Analysis dated 02nd February 2024

Nifty Feb F: 21951 [ 22198 / 21877 ] Open Type OD (Open Drive) Volumes of 38,708 contracts Above average Initial Balance 185 points (22065 – 21877) Volumes of 68,512 contracts Above average Day Type Normal Variation – 322 points Volumes of 2,36,827 contracts Above average NF moved away from the 4-day balance with a gap […]

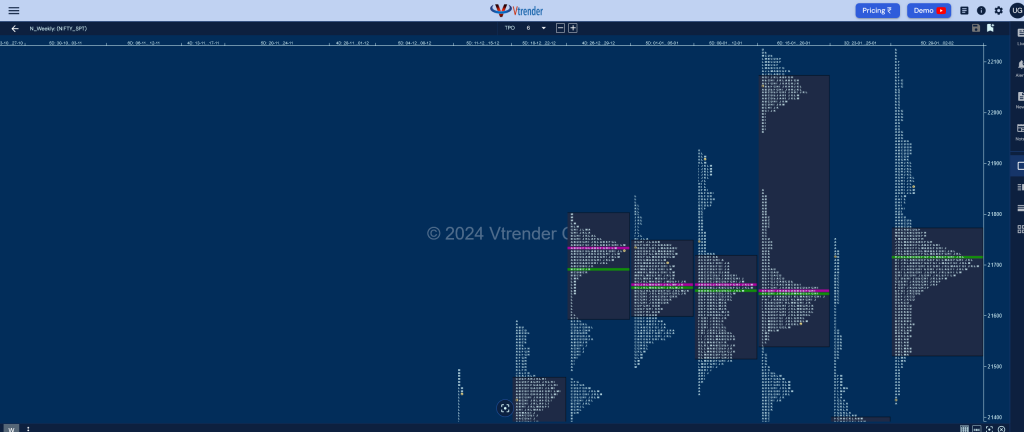

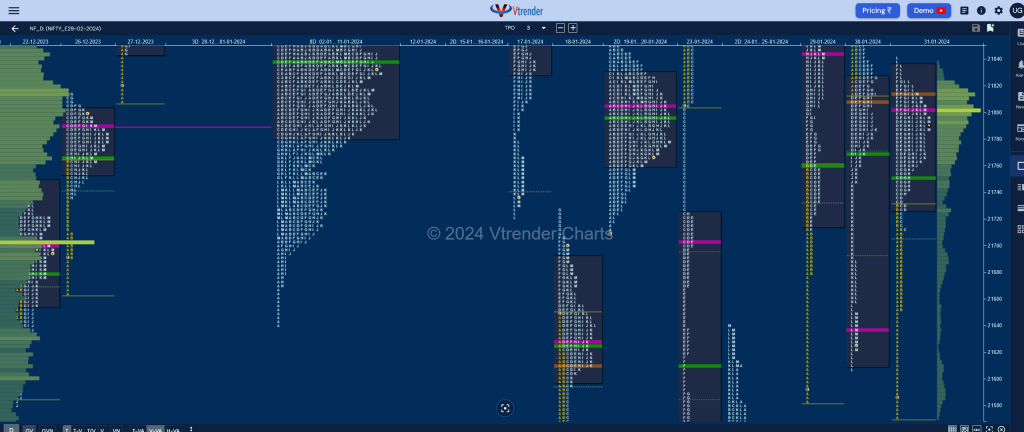

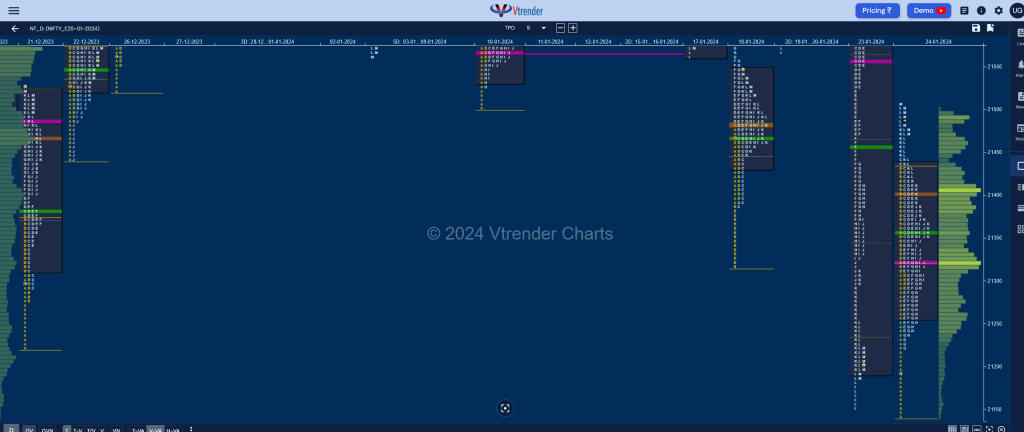

Weekly Spot Charts (29th Jan to 02nd Feb 2024) and Market Profile Analysis

Nifty Spot: 21853 [22126 / 21429 ] Previous week’s profile represented a ‘b’ shape one with completely lower Value at 21231-21300-21399 but had left a good responsive buying tail from 21192 to 21137 with a close at 21352 but has an initiative selling tail from 21731 to 21750 along with couple of extension handles at 21629 […]

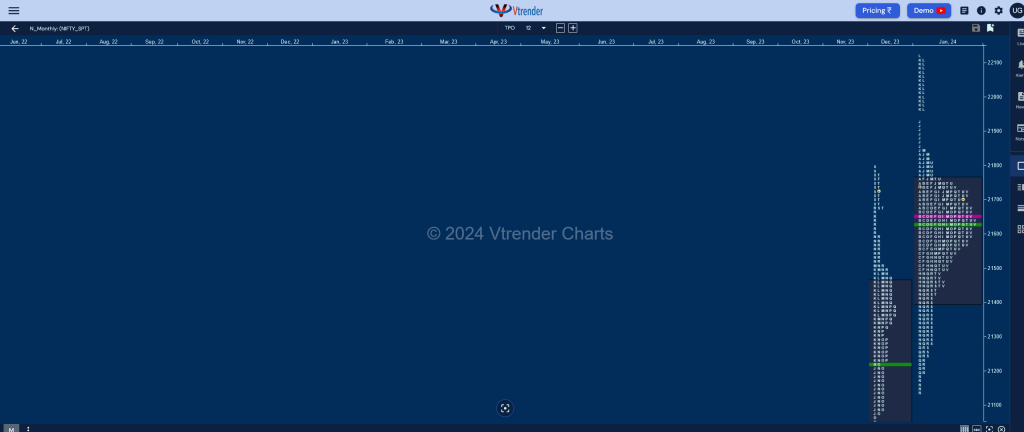

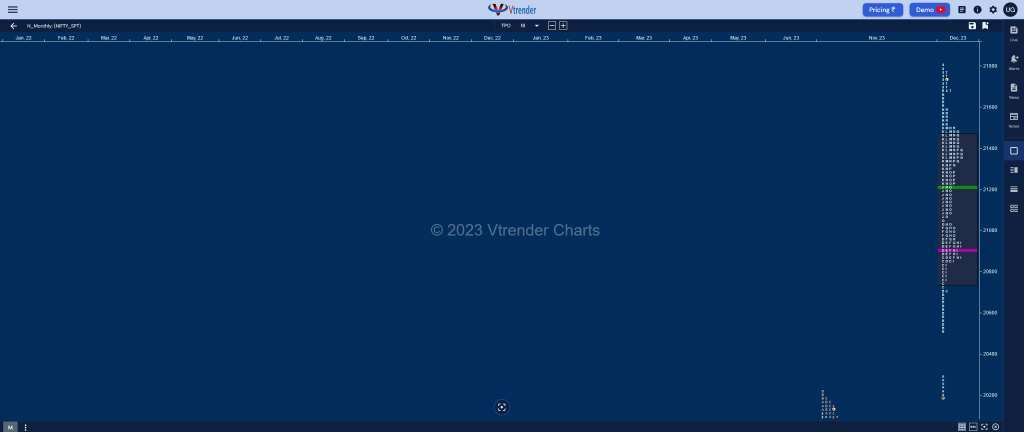

Monthly charts (January 2024) and Market Profile Analysis

Nifty Jan Spot: 21725 [ 22124 / 21137 ] Previous month’s report can be viewed here Nifty has formed a Neutral monthly profile for January where it hit new ATH of 22124 on 16th but displayed exhaustion to the upside with a 2-day balance with a prominent POC at 22054 from where it made a trending […]

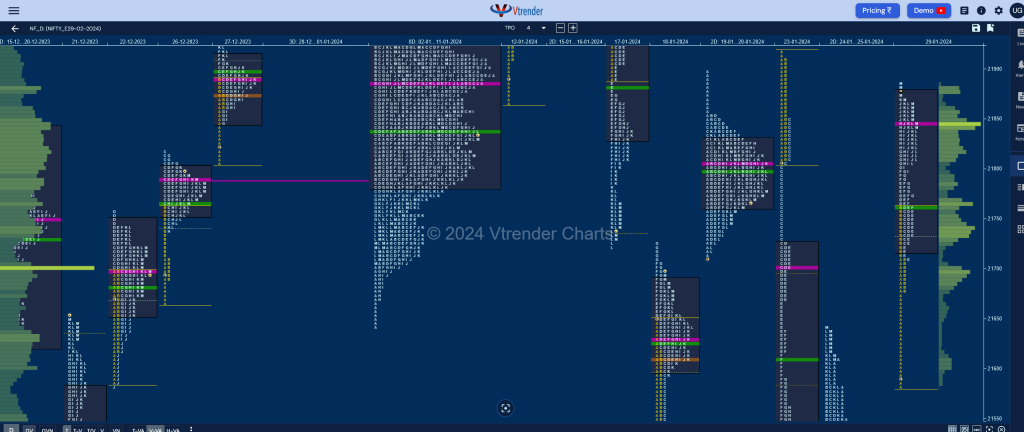

Market Profile Analysis dated 01st February 2024

Nifty Feb F: 21751 [ 21920 / 21725 ] Open Type OAIR (Open Auction In Range) Volumes of 12,380 contracts Below average Initial Balance 118 points (21890 – 21772) Volumes of 35,533 contracts Range average & volumes below Day Type Neutral Extreme – 195 points Volumes of 1,80,971 contracts Below average NF opened in previous Value […]

Market Profile Analysis dated 31st January 2024

Nifty Feb F: 21808 [ 21840 / 21570 ] Open Type ORR (Open Rejection Reverse) Volumes of 15,838 contracts Average Initial Balance 160 points (21729 – 21570) Volumes of 38,629 contracts Range above average & volumes average Day Type Normal Variation – 270 points Volumes of 1,46,625 contracts Average NF gave a follow down to previous […]

Market Profile Analysis dated 30th January 2024

Nifty Feb F: 21630 [ 21938 / 21607 ] Open Type OA (Open Auction) Volumes of 18,922 contracts Average Initial Balance 124 points (21938 – 21815) Volumes of 38,512 contracts Average Day Type Trend – 332 points Volumes of 1,63,520 contracts Above average NF continued previous day’s Trend Up imbalance with another higher open scaling above […]

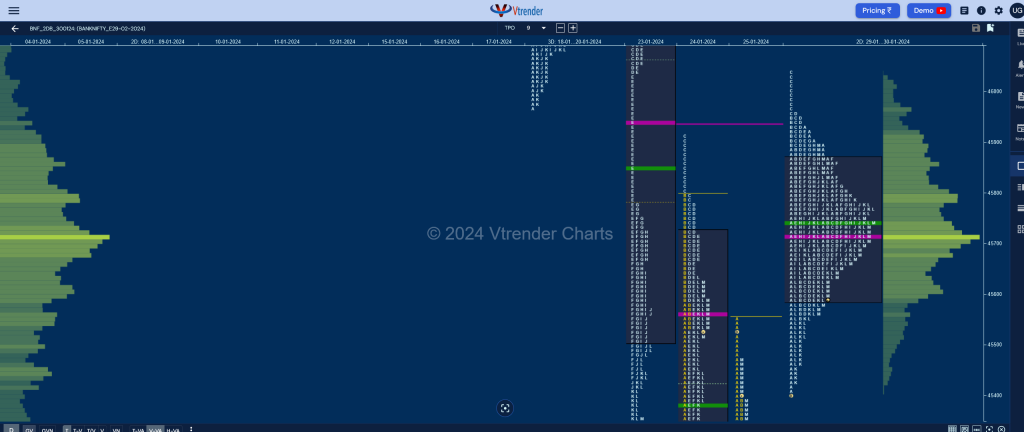

Market Profile Analysis dated 29th January 2024

Nifty Feb F: 21855 [ 21885 / 21575 ] Open Type OD (Open Drive Up) Volumes of 32,910 contracts Above average Initial Balance 185 points (21760 – 21575) Volumes of 60,205 contracts Above average Day Type Trend – 310 points Volumes of 1,81,214 contracts Above average NF made a higher open and took support right at […]

Market Profile Analysis dated 25th January 2024

Nifty Feb F: 21488 [ 21611 / 21394 ] Open Type OAIR (Open Auction In Range) Volumes of 13,510 contracts Below average Initial Balance 115 points (21611 – 21496) Volumes of 34,569 contracts Average Day Type Normal Variation – 217 points Volumes of 1,84,170 contracts Average NF not only rejected the previouse spike close from 21582 […]