Introduction to Failed Auctions in Trading

In the realm of market trading, understanding the nuances of various concepts can significantly enhance a trader’s strategy and overall performance. One such intriguing concept is the “failed auction,” which offers a fascinating insight into market dynamics and potential trading opportunities.

This blog post delves into the essence of failed auctions, drawing on expert knowledge to elucidate how traders can leverage this concept for better market outcomes.

Understanding the Concept of Failed Auctions

A failed auction occurs when the market attempts to establish new price levels but fails, indicating a potential reversal or continuation of trends. It’s a pivotal moment that signals the market’s inability to find value at new highs or lows, thus serving as a critical indicator for discretionary rules-based traders (DRB).

A DRB is a trader who has a clear understanding of the rules by which he trades and yet he leaves it to his discretion to activate or not activate the trade. This is important because every trade and every setup is different as the market moves and no 2 trades are anytime similar.

How does the Failed Auction work in markets

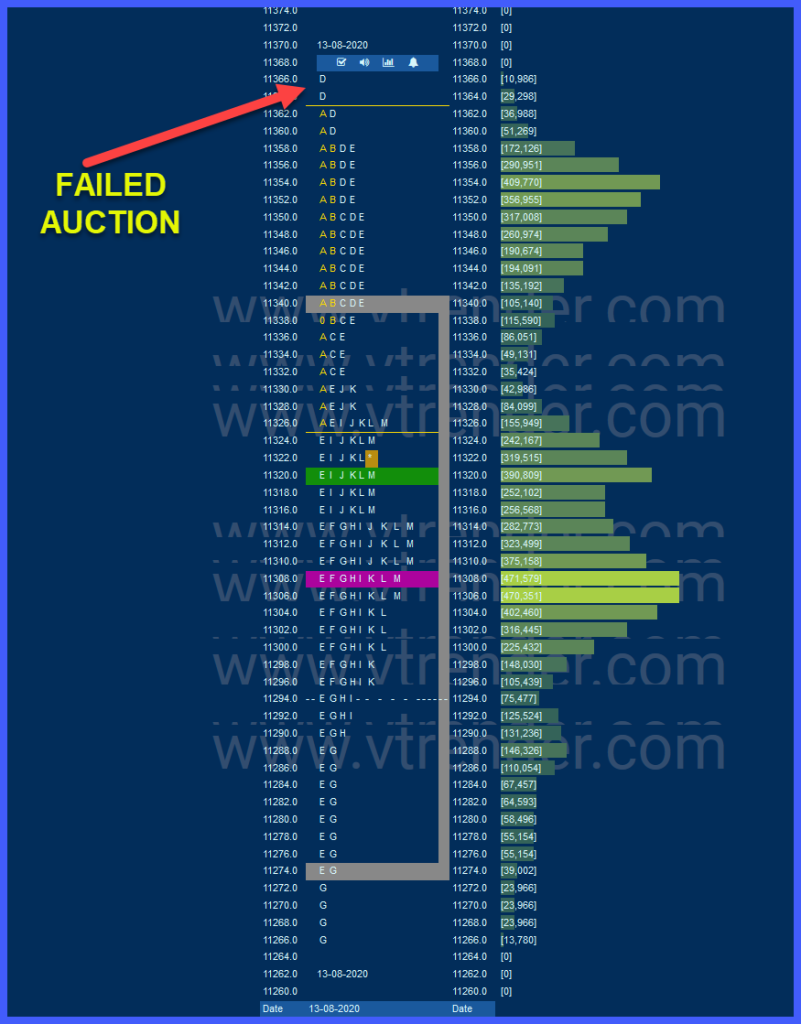

Failed Auction Theory: A failure to stay outside the initial balance for more than 30 minutes (on one side), followed by a revisit inside the initial balance and an opposite move on the other side of the Initial Balance.

After a failed auction, the initial move is in the direction opposite to the one that failed, but the beauty of the theory as pointed by Ray Barros is that the market will revisit the failed auction zone in about 5-6 days in over 75 % of the cases

The Initial Balance or IB as the name would suggest is the first 60 minutes of the session where we saw 2 both buyers and Sellers fairly active in an equal measure or in a balance.

This is an important concept used in the MarketProfile for every day trading. Explore some more concepts at – https://vtrender.com/understanding-market-profile-a-modern-traders-guide/

The Strategic Importance of Failed Auctions

Failed auctions are not merely anomalies; they are profound indicators that provide clarity on market sentiment and direction. With years of trading experience underscoring the accuracy and effectiveness of utilizing failed auctions, traders can significantly enhance their decision-making process. These moments of market failure are astronomical, offering low-risk and high-reward trading setups that astute traders eagerly anticipate.

Trading with the Failed Auction Concept

Trading based on failed auctions involves understanding market structure, mechanisms, and the subtleties that accompany these events. It’s about recognizing the signs of a failed auction and employing a set of rules to capitalize on the ensuing market movement.

This process requires a deep understanding of market profile analytics and a strategic approach to order flow analysis, enabling traders to navigate the market with precision and confidence. More detail about the setup including points of entry and possible targets of the strategy is covered at – https://vtrender.com/of-failed-auctions-and-revisits/

Conclusion

The concept of failed auctions presents a unique opportunity for traders to refine their strategies and achieve greater success in the market. By understanding and applying the insights from failed auctions, traders can navigate the complexities of market dynamics with an informed and strategic approach.

An inside view of the Buying and Selling happening in the markets can be checked via an Orderflow Chart. The Orderflow chart shows the BUYING and the SELLING happening at the exchanges in real time to traders on a chart. You can read more about the Orderflow at – https://vtrender.com/what-is-order-flow/

Embarking on a Journey of Market Mastery

We invite you to explore the world of failed auctions further and consider how this concept can enhance your trading strategy. For more insights and strategies on market trading, stay tuned to our blog.

Your journey towards mastering the market with failed auctions starts here.