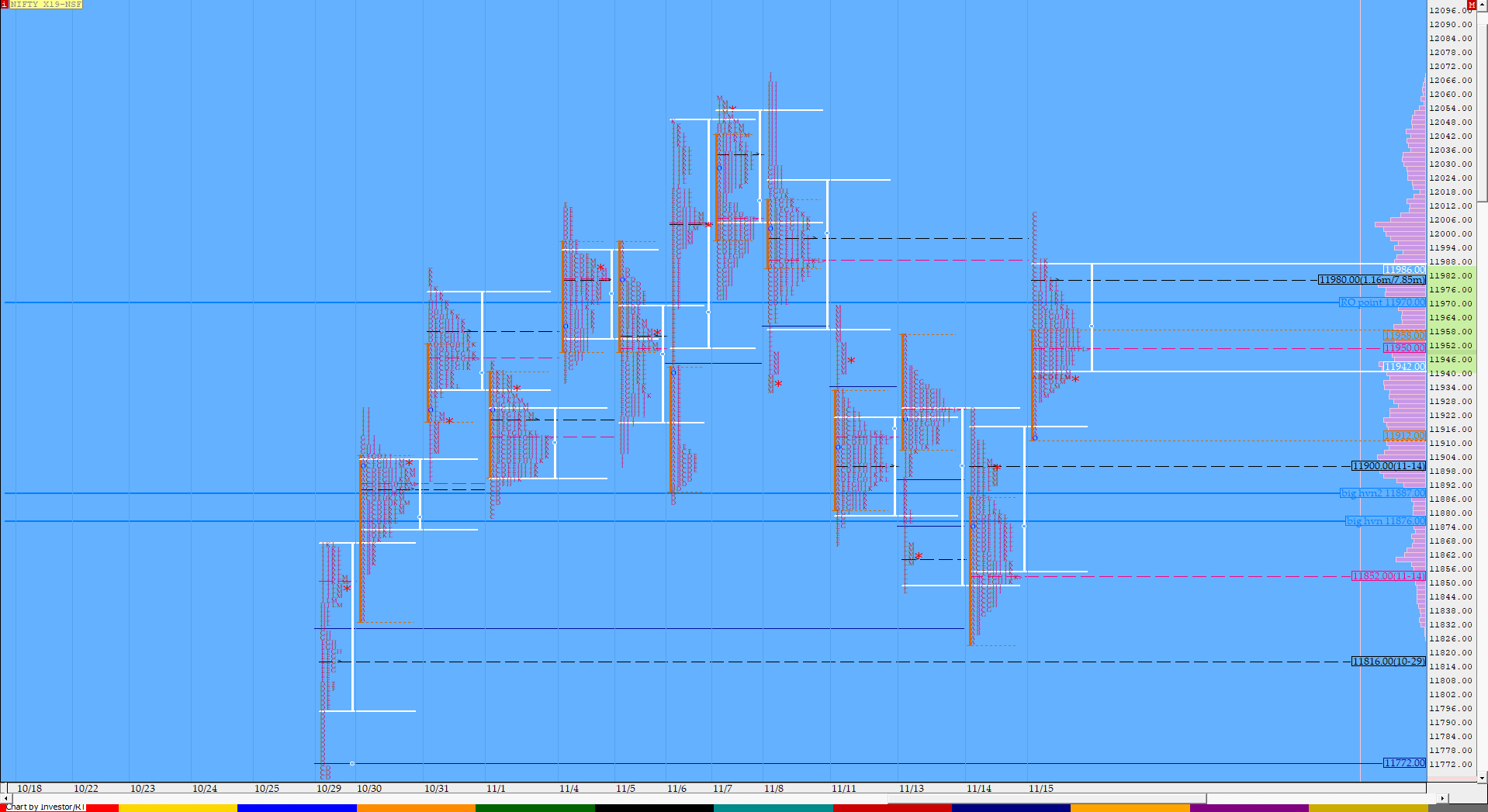

Nifty Nov F: 11943 [ 12009/ 11913 ]

HVNs – 11667 / 11760 / 11814 / 11901 / 11935 / 11980

Previous day’s report ended with this ‘the auction is not finding aggressive sellers after moving lower from the 5-day composite hence can attempt a move back into the higher composite Value of 11933-11979-12009‘

NF opened higher plus gave a OL (Open=Low) start at 11913 after which it stayed above PDH (Previous Day High) to confirm an OAOR (Open Auction Out of Range) along with a buying tail from 11928 to 11900 as it made a typical narrow IB range of just 46 points post an OAOR. The acceptance inside the above mentioned composite Value meant that the auction is on for the 80% Rule but the manner in which it completed it came as a surprise as it spiked higher just as the ‘C’ period began tagging that composite VAH of 12009 to the dot but was not able to get above it indicating return of supply in this zone and gave an equally quick probe to the downside where it got supported at 11933 which was the composite VAL to the dot. NF remained in this composite Value for the rest of the day as it left a PBH (Pull Back High) of 11989 in the ‘J’ period and marginally broke below the 11933 level in the closing minutes as it tagged 11930 before closing at 11943 leaving a nice 3-1-3 balance profile with higher Value but also a selling tail from 11989 to 12009. The auction has a good chance of moving away from this profile in the next session depending on which of the excess gets negated.

(Click here to view the previous week’s auction in NF)

- The NF Open was an Open Auction Out of Range (OAOR)

- The day type was a Normal Variation Day (Up)

- Largest volume was traded at 11937 F

- Vwap of the session was at 11959 with volumes of 96.8 L and range of 96 points as it made a High-Low of 12009-11913

- NF confirmed a multi-day FA at 11465 on 16/10 and completed the 2 ATR move up of 11776. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11503 on 17/10 and completed the 2 ATR move up of 11808. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11162 on 09/10 and completed the 2 ATR move up of 11554. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 29/10 at 11810 will be important reference on the downside.

- The settlement day Roll Over point (Nov) is 11970

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11932-11937-11971

Hypos / Estimates for the next session:

a) NF has immediate supply at 11950-958 above which it could rise to 11971-982 / 12003-10 & 12027-50

b) Immediate support is at 11935-930 below which the auction could fall to 11910-901 / 11889-880 / 11860 & 11846-833

c) Above 12050, NF can probe higher to 12064-80 / 12112 & 12133-148

d) Below 11833, auction becomes weak for 11816-810 / 11795 / *11771-767* & 11749-734

e) If 12148 is taken out, the auction go up to to 12166 / 12185-199 & 12226-236

f) Break of 11734 can trigger a move lower to 11716-709 / *11689-667* & 11645

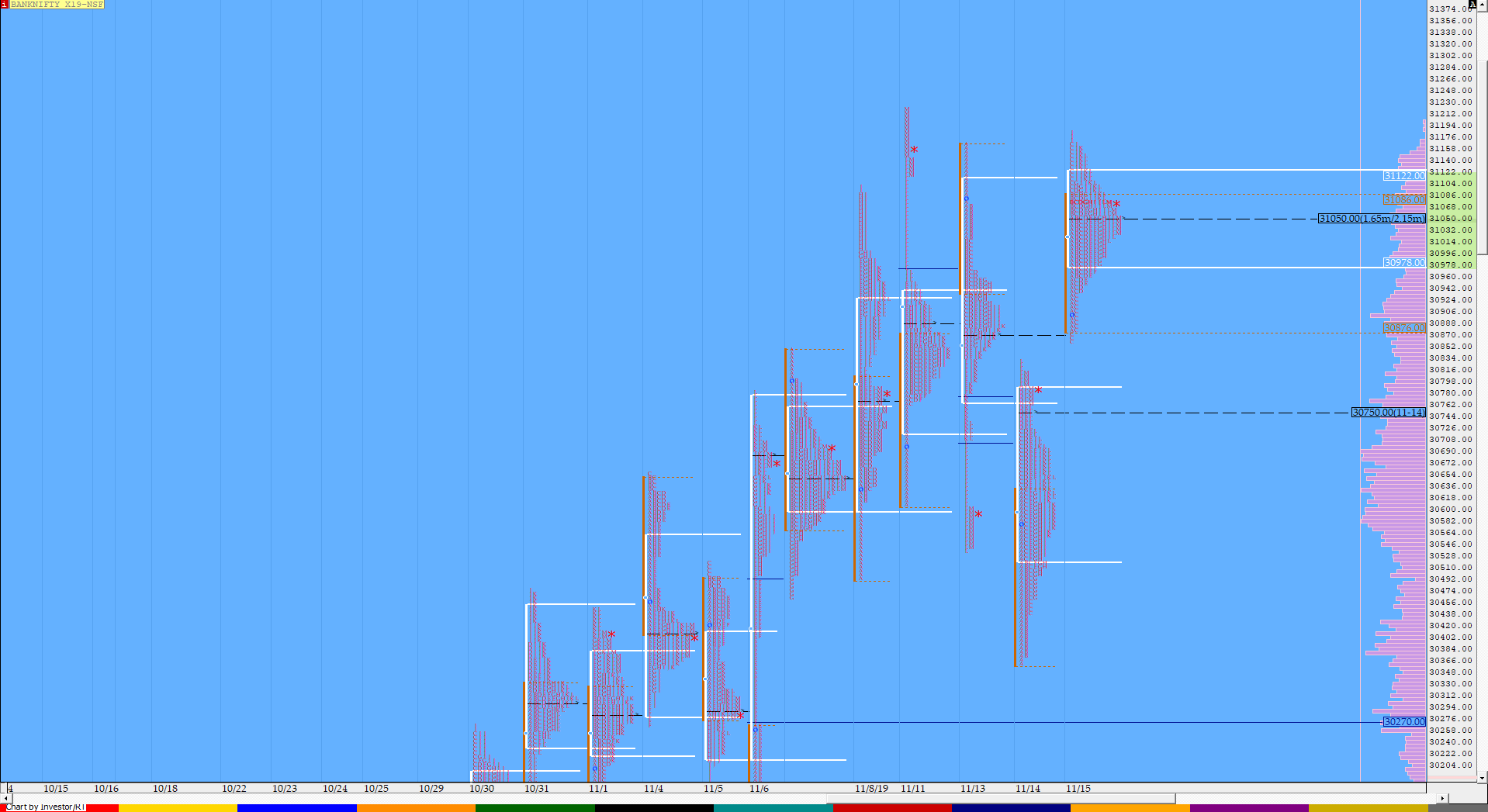

BankNifty Nov F: 31052 [ 31185 / 30860]

HVNs – 30075 / 30150 / 30288 / 30400 / 30690 / 30760 / (30990) / 31050 / (31130)

Previous day’s report ended with this ‘closing around the VAH of the day which signaled the failure of sellers so a test of the vPOC of 30870 & 30900+ could be on the cards in the next session‘

BNF also opened higher much above the PDH as it made a low of 30880 and continued to rise in the IB making a high of 31090 but similar to the auction in NF, here also there was a spike in the ‘C’ period as the auction got into that excess of 31072 to 31223 making a high of 31165 and was swiftly rejected as it went on to make new lows for the day at 30860 in a matter of 15 minutes as the ‘C’ period left a huge range of 305 points. BNF was strongly rejected at the new lows also as it climbed back above IBH in the ‘D’ period thereby confirming a FA (Failed Auction) at lows but remained in the ‘C’ period range for most of the day with the FA triggering a slow probe higher and this led to a marginal new high of 31185 for the day in the ‘J’ period but once again there was a swift correction as BNF dropped to 31018 in the ‘L’ period before closing at the HVN & dPOC of the day which was at 31050. Value for the day was higher but the range of just 325 points was the lowest not just for this series but for the last 2 months indicating poor trade facilitation and a good chance of a range expansion happening in the coming session(s)

(Click here to view previous week’s auction in BNF)

- The BNF Open was an Open Auction Out of Range (OAOR)

- The day type was a Neutral Day

- Largest volume was traded at 31050 F

- Vwap of the session was at 31046 with volumes of 40.2 L and range of 325 points as it made a High-Low of 31185-30860

- BNF confirmed a fresh FA at 30052 on 06/11 and tagged the 2 ATR target of 31049 on 08/11. This FA has not been tagged since & hence is now positional support

- BNF confirmed a FA at 27900 on 09/10 and completed the 2 ATR move up of 29779. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 06/11 at 30447 will be important reference on the downside.

- The Trend Day VWAP of 29/10 at 29945 will be important reference on the downside. This was tagged on 30/10 and broken but was swiftly rejected so proves to be support.

- The old Trend Day VWAP of 08/07 at 30995 is no longer valid reference now as BNF closed below this on 13/11

- The settlement day Roll Over point (Nov) is 30150

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30979-31050-31112

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31090 for a rise to 31135-165 / 31209-255 / 31310-326 & 31384-395

b) Support is at 31048-18 below which the auction could test 30979-950 / 30880-860 & 30770-750*

c) Above 31395, BNF can probe higher to 31417-440 / 31490 & 31560

d) Below 30750, lower levels of 30688-658 / 30585-580 & 30540

e) If 31560 is taken out, BNF can give a fresh move up to 31618-640 / 31680 & 31727-740

f) Below 30540, we could see lower levels of 30500-460 / 30375-370 & 30310-281

Additional Hypos

g) Above 31740, higher levels of 31784*-803 / 31875 & 31929-949 could get tagged

h) Break of 30281 could trigger a move down to 30225 / 30150-131 & 30072-50

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout